Rural Opportunity Zone (ROZ)

Kansas has what you’re looking for when it comes to natural beauty, simplicity and communal bonds of rural life. We want you to experience rural Kansas so much that we’ll even throw in some added bonuses.

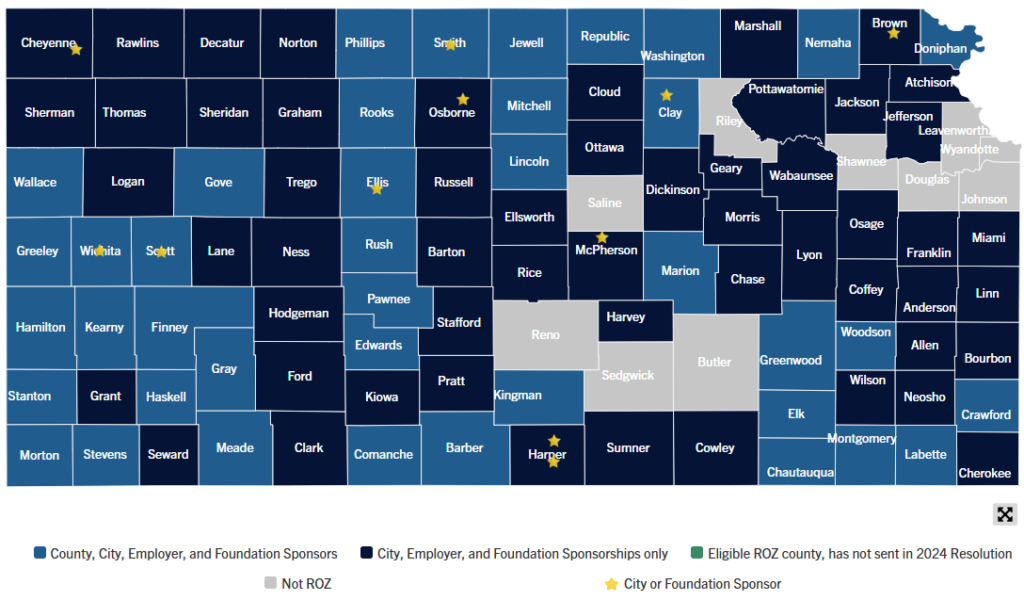

The state of Kansas has designated 95 counties as “Rural Opportunity Zones,” which comes with significant added benefits. Designated counties offer one or both of the following financial incentives for new full-time residents:

– Student Loan Repayment Assistance

What is ROZ Student Loan Reimbursement Assistance?

- ROZ Student Loan Reimbursement Assistance is administered By Kansas Department of Commerce (KDC)

- Partners with Counties, Cities, Employers, and Foundations

- Provides up to $15,000 in Student Loan Repayment Assistance over 5 years

You May Be Eligible for ROZ Student Loan Reimbursement Assistance

- Your address must be newly established and permanent in a participating county (see map above), so long as that address was established after the county began participating in the program.

- Applicants must have an active student loan balance in their name, as well as an associate’s, bachelor’s or post-graduate degree prior to moving to the participating county.

- To apply, you will need to provide proof of domicile in the ROZ County, proof of previous permanent residency (prior to earning your degree), transcripts with degree dates and student loan balance with distribution dates.

Application Period

- Applications are open for Gold and Blue Counties. Applications close September 30th.

– ROZ 100% State Income Tax Credit

What is ROZ 100% State Income Tax Credit?

- ROZ Income Tax Credit is administered By Kansas Department of Revenue (KDOR)

- The credit is 100 percent of the taxpayer’s Kansas tax liability.

- The credit is limited to the amount of the taxpayer’s Kansas tax liability.

A resident individual may claim this credit for not more than five consecutive years following establishment of their domicile in a rural opportunity zone. This assumes the individual establishes domicile in a rural opportunity zone on or after July 1, 2011 and prior to January 1, 2026 and was domiciled outside this state for five or more years immediately prior to establishing their domicile in a rural opportunity zone in this state. If an individual establishes their domicile in a rural opportunity zone after January 1, 2019, the number of years for which they can claim the credit will be reduced. The last opportunity to claim the credit will be on the individual’s 2026 tax year return, which will be filed in 2027.

More information regarding qualifications

Rural Opportunity Zone frequently asked questions

You May Be Eligible for ROZ 100% State Income Tax Credit

- Establish domicile in a rural opportunity zone on or after July 1, 2011 and prior to Jan. 1, 2026.

- Must have been domiciled outside Kansas for five or more years immediately prior to establishing their domicile in a Kansas rural opportunity zone.

- Have had no more than $10,000 in Kansas source income in any one year for five or more years immediately prior to establishing their domicile in a Kansas rural opportunity zone;

- Must have been domiciled in a Kansas rural opportunity zone during the entire taxable year for which the credit will be claimed;

- The tax return on which the credit is claimed must be timely filed (including an extension of time); and

- The taxpayer may not be delinquent in filing any tax return with or paying any tax due to the state of Kansas or any political subdivision.

For questions regarding ROZ applications and eligibility please visit the Kansas Department of Revenue

Local Community Incentives

Local communities in Kansas are excited about the prospect of adding dairies to their community and offer competitive packages ranging from loans to providing land for building sites.

Taxes, Credits and Exemptions

Agricultural Projects Sales Tax Exemption

Beginning July 1, 2014 a sales tax exemption is available for capital investment in agriculture including dairies. Which means construction, reconstruction, enlargement or remodeling of a facility with a total cost of the project totaling no less than $50,000 may be granted.

In total, the following are eligible for agricultural exemption in Kansas: ingredient or component parts; parts consumed in production; propane for agricultural use; property purchased is farm or aquaculture machinery or equipment, repair/replacement parts, or labor services on farm or aquaculture machinery; seeds, fertilizers, insecticides, herbicides, germicides, pesticides, fungicides.

Machinery & Equipment Property Tax Exemption

A state and local property tax exemption is available for new or used commercial and industrial machinery, and equipment acquired by qualified purchase or lease, or transferred into the state for the purpose of expanding an existing facility or establishing a new facility.

Sales Tax Exemption

In addition to other sales tax exemptions, the following ag-based items are exempt from sales tax:

- Purchases of animals primarily used for agriculture

- Production of food for human consumption, animal or dairy products, or offspring for use in any such endeavor.